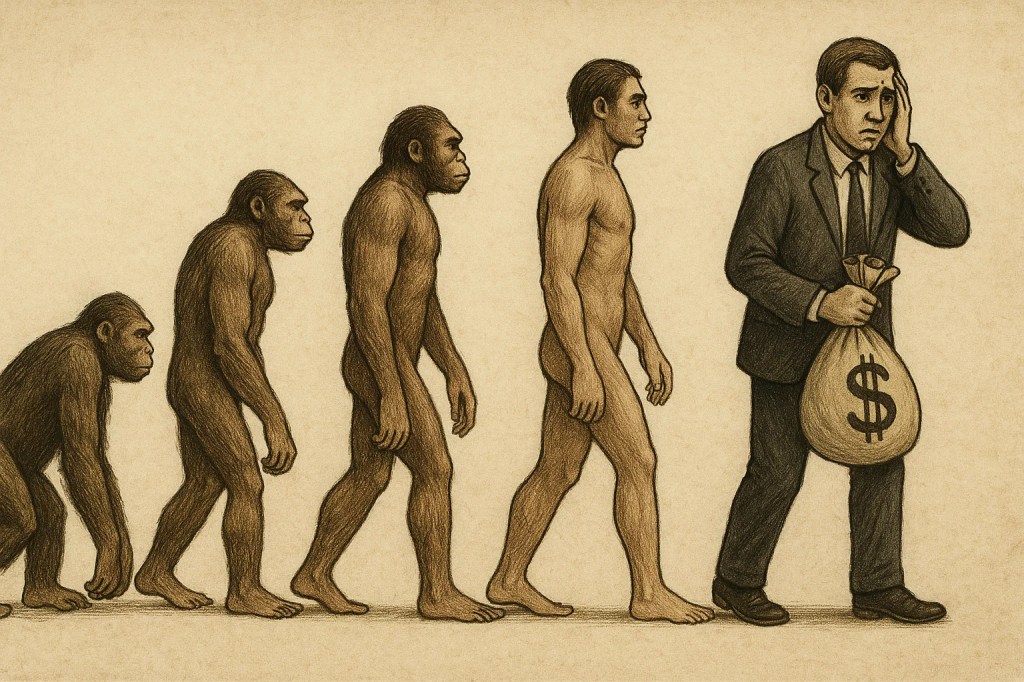

Human nature may be shaped by much older codes than we think. The roots of our anxieties might lie deep within our evolutionary history. These ancient codes may still be triggering us in today’s modern world.

In The Denial of Death, Ernest Becker argues that humans have evolved into “hyper-anxious” beings. He writes:

“Darwinians thought: early men who were most afraid were those who were most realistic about their situation in nature, and they passed on to their offspring a realism that had a high survival value. The result was the emergence of man as we know him: a hyperanxious animal who constantly invents reasons for anxiety even where there are none.”

In other words, the most cautious early humans—those who feared, hesitated, and avoided risk—were the ones who survived. That tendency was passed down through generations, bringing us to where we are now: a species capable of generating anxiety even when there’s no real cause.

Modern Threats: Money, Status, and the Future

We no longer need to run from a tiger in the forest to survive. But that internal alarm system still runs strong. And if you ask what triggers it the most today: it’s money. Or more precisely, the uncertainty, status pressure, and future worries that revolve around it.

The wealthy live in fear of losing what they have; the poor fear not being able to sustain their lives. And the middle class? Perhaps they feel the most squeezed—juggling the fear of losing what they’ve gained while trying to appear as if they belong to the next tier. A better house, a better vacation, a better car… each becomes a fresh source of anxiety. As our income increases, so does our standard of living—and instead of easing our worries, this only adds to them.

The Sense of Enough: Knowing When to Stop

Maybe the real problem starts here: the concept of a “saturation point” has all but vanished. “Enough” has become a moving target. But if we could pause for a moment, define what’s enough for us, and keep the rest as a safety net, that might significantly ease our anxieties.

If we could distance ourselves just a bit from status addiction, constant comparison, and the idea that “more is always better,” perhaps we’d find ourselves closer to peace.

Revisiting Our Relationship with Money

Then there’s the matter of how we manage money. Especially when it comes to investing, our minds are haunted by the question: “What if I lose it?” This is where risk appetite comes into play. We should be asking ourselves: What kind of investment would let me sleep peacefully at night?

Since everyone’s perception of risk is different, “safe” for one person may mean time deposits, while for another it might mean index funds or hand-picked stocks. The key is to stay within what we know and resist getting caught up in other people’s games and FOMO.

The Bottom Line: Choose What’s Right—Not What’s More

By improving our financial literacy, following a path that matches our risk profile, and—most importantly—not blindly chasing “more,” we can lead lives that are less anxious and more content. That’s how we bring peace to both our wallets and our minds.

If we can build and commit to a financial and lifestyle model that truly suits us and free ourselves from the constant chase for more, I’m confident we can reduce our anxieties to a minimum.